On Friday, Indian stocks fell for a second consecutive day, shedding almost $83 billion in market value. Investors were alarmed by the escalating military conflict between India and Pakistan.

Since Wednesday, the nuclear-armed neighbors have been at odds after India bombed several civilian targets in Pakistan in retaliation for a deadly incident in India’s Kashmir last month, which was allegedly done by Pakistan. Even though India didn,t has any proof.

Pakistan retaliated after being angered by this, and the two nations have subsequently engaged in cross-border strikes.

On Friday, the BSE Sensex (BSESN) also dropped 1.1% but ended below the 80,000 level it had held the day before, while the Nifty 50 (NSEI) declined 1.1% but closed over the psychologically significant 24,000-point threshold. The market was expected to lose $108 billion at its lowest point.

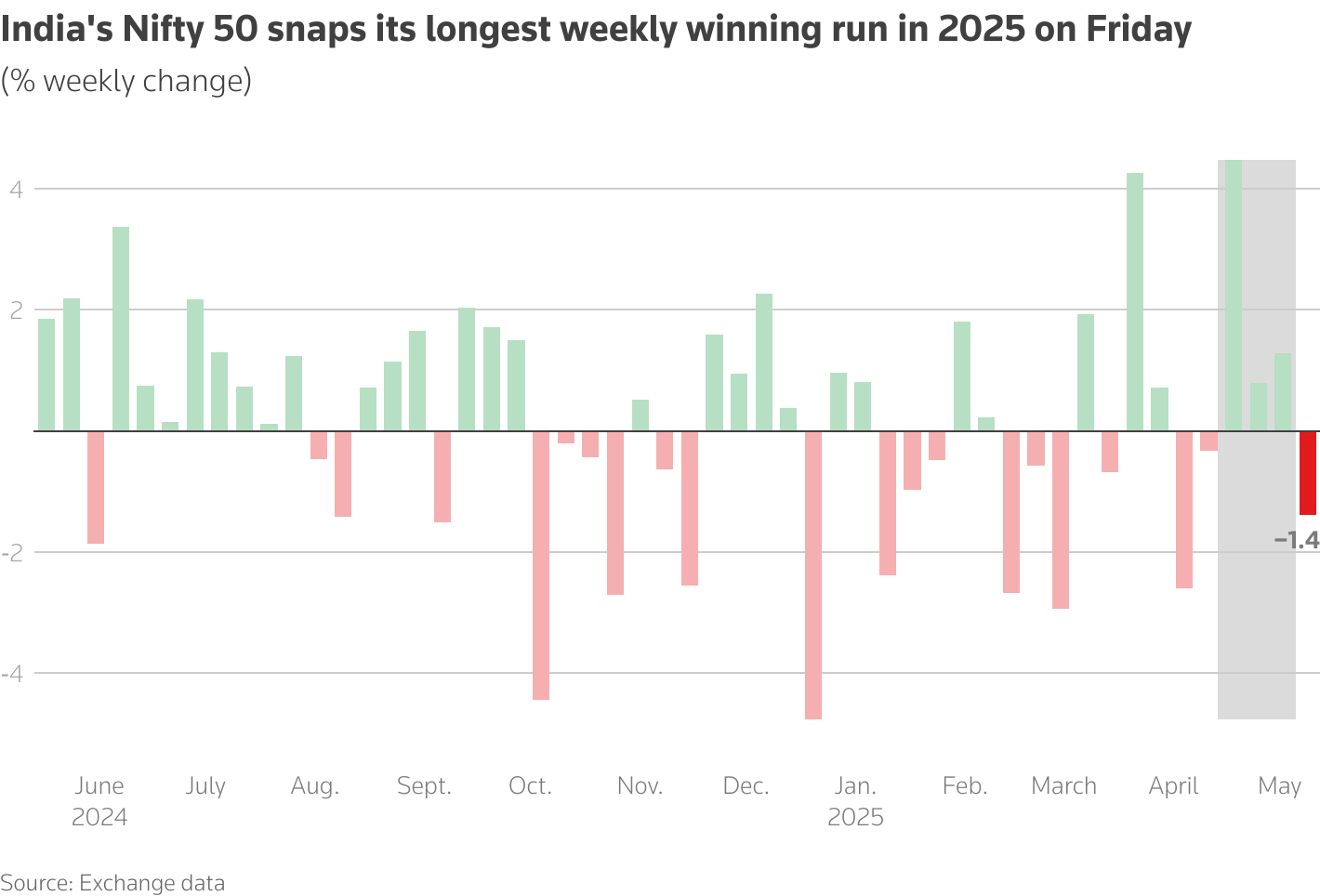

The indices ended a three-week gain streak, the longest of the year, on Thursday, dropping roughly 0.5% and losing roughly 1.3% so far this week.

The head of research at Profitmart Securities, Avinash Gorakshaka, stated:

“With so much escalation, local markets are anxious since further retaliatory measures from Pakistan could lead to a prolonged, full-fledged conflict.”

“Fundamentals will take a back seat while sentiment influenced by updates from the conflict could derail market momentum at least for a week if the fighting continues.”

Known as the “fear gauge,” the volatility index (NIFVIX) increased for eight consecutive sessions to reach a high of more than one month.The central bank had to intervene to stop the rupee’s decline as other asset classes also suffered.The impact on the stock market was wide.

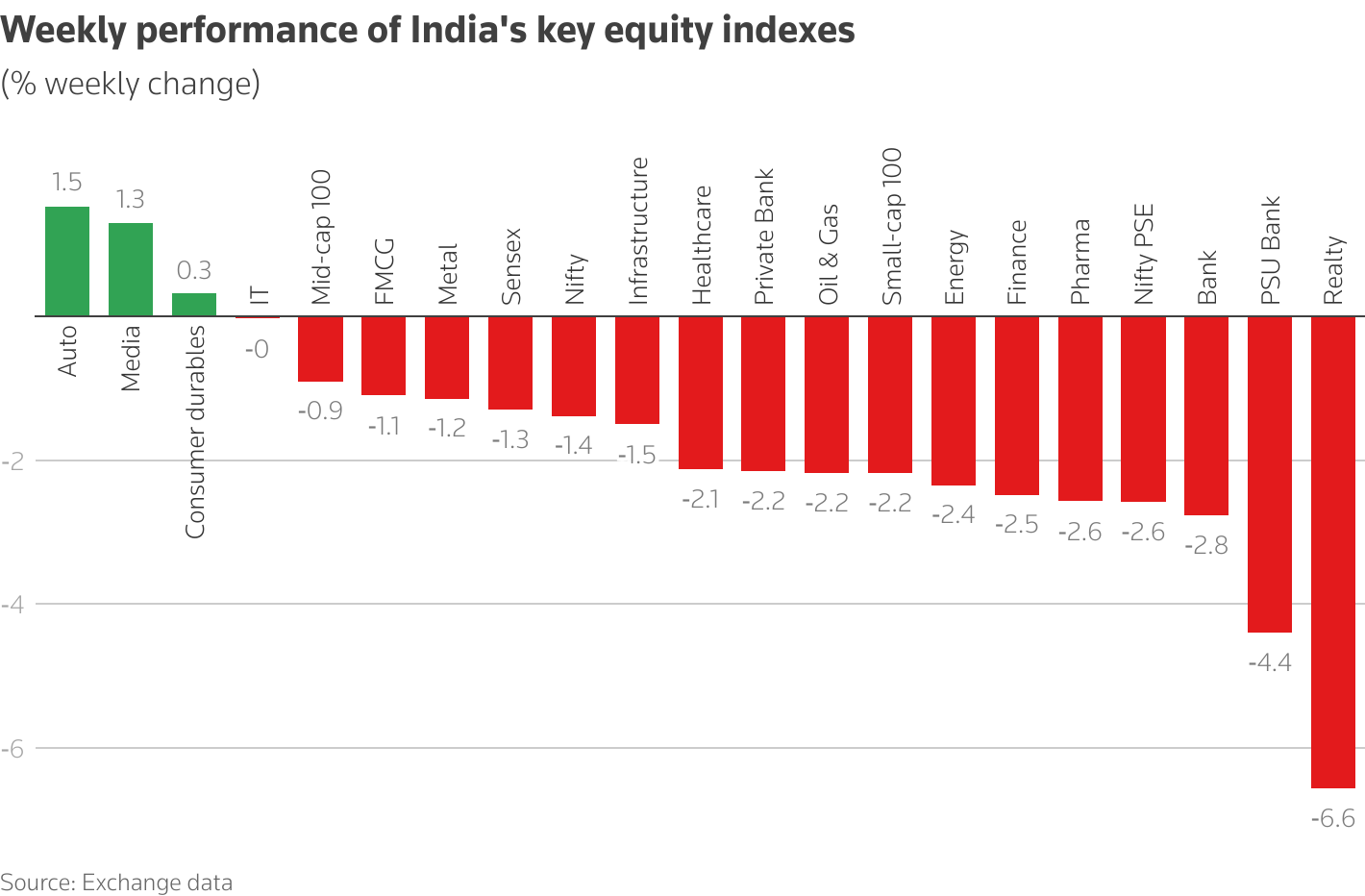

This week, the small-caps (NIFSMCP100) and mid-caps (NIFMDCP100) saw losses of 1.9% and 0.8%, respectively, while twelve of the 13 key sectors had declines.

The only positive development was the 8.7% increase in car stocks, which was driven by Tata Motors’ (TAMO.NS) optimism that the UK-US trade agreement will improve the performance of its British subsidiary JLR.

Out of the 11 members of Nifty 50, it was the top that saw some gains this week.